The Impact of a New Subway Line on Property Values in

Helsinki Metropolitan Area

Juhana HIIRONEN, Kirsikka

RIEKKINEN

and Hanna TUOMINEN, Finland

1)

This paper was presented at the FIG Working Week in Sofia, Bulgaria,

17-21 May 2015. This paper illiminates whether a new subway line will

have an impact on residential apartment values and on public revenues.

SUMMARY

The planning process of a new subway line started in 2007 in the

Helsinki metropolitan area. The construction works were started in 2009

and the new subway line is planned to be opened by the end of 2015. As a

result of the new subway line the travelling time to the city center

decreases. The prediction of economic theory would be that housing

prices near the subway stations would increase as a result of having

better access and lower cost of traveling within the city. The empirical

evidence on these predictions is however missing, at least in Finland.

The objective of this article is to illuminate whether this new

subway line will have an impact on residential apartment values and on

public revenues. The research questions are: how far does the effect of

a new subway line reach (Q1); how big (%) is the average impact on

apartment values (Q2) and; how big (€) is the total impact on apartment

values (Q3). The article also discusses how the rail-induced value

increases effect public revenues. The first question was analyzed and

answered based on literature review. The second question was analyzed

based on hedonic approach. The third question was answered based on the

two previous questions.

The results showed that a new subway station has an impact that

reaches in most surroundings at least to 400 meters. The impact that the

new subway station had on residential apartment values was on average

11-15 percent in the studied area. The total impact in the studied area

was approximately 122-193 million euros. It was estimated that the

rail-induced value impact increased the city’s revenues from property

taxes for almost 10 percent.

1 INTRODUCTION

The planning process of a new subway line started in 2007 in the

Helsinki metropolitan area. The construction works begun in 2009. The

new subway line is planned to be opened by the end of 2015. This study

analyzes the value impact that the new subway line will have on one

residential area. The case area called Matinkylä will have its own

subway station by the end of 2015. Whether this new subway line will

have an impact on apartment values and further more on public revenues

is a question that will be illuminated in this article.

The prediction of economic theory would be that housing prices near

the subway stations would increase as a result of having better access

and lower cost of traveling within the city (Alonso 1968, p. 59; Mills

1967, p. 200; Muth 1970, p. 5-6). As a result of the new subway line the

travelling time to the city center decreases. The decreased travelling

time increases the wellbeing of the community which causes growth in the

prices of residential apartments. The prices will keep increasing

because of the higher demand until the wellbeing has been restored to

its previous level due to the increased living expenses. The empirical

evidence on these predictions is however missing, at least in Finland.

As regards funding for public transit, one should point out that

possible public-transit induced premium on sales of residential

apartments generates additional revenue from property taxes. This effect

of public transport has been largely filtered out in the discussion of

funding for public transit, which might be due to the lack of empirical

evidence so far regarding the influence of rail infrastructure on house

prices in Finland. This study is to help to close this gap by analyzing

the contribution of rail-induced price increases to the funding of

public transport.

Therefore the effect of the new subway line in the Helsinki

metropolitan area becomes an empirical question. The goal of this study

is to estimate is there such an impact. The research question regarding

property prices is divided in three sub-questions:

- How far (meters) does the effect of a new subway line reach

(Q1)?

- How big (%) is the average impact (Q2)?

- How big (€) is the total impact (Q3)?

The average impact means the percentage increase of real estate value

and total impact the absolute increase of real estate value. The first

question is analyzed and answered based on a literature review. The

second question is analyzed based on a hedonic approach. The third

question will be answered based on the two previous questions. The

contribution of rail-induced price increases will be analyzed and

discussed based on the third question.

The study contributes to an understanding of the hitherto little

explored influence of income level on the connection between access to

railway infrastructure and residential apartment prices. Literature

review section provides an overview of the current literature on the

subject. Materials and methods section describes the data that forms the

basis of the study and illustrates the empirical models used. In the

Results section the answers to the research questions are given based on

the material and methods used. Discussion and conclusions are presented

in last section.

2 LITERATURE REVIEW

There are two main questions that need to be reviewed when the total

impact of a new subway line is analyzed. The first question is how far

the impacts (positive or negative) reach. The second question is how

strong the impact in the chosen or revealed area is.

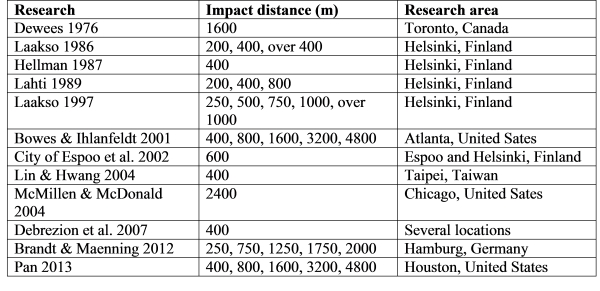

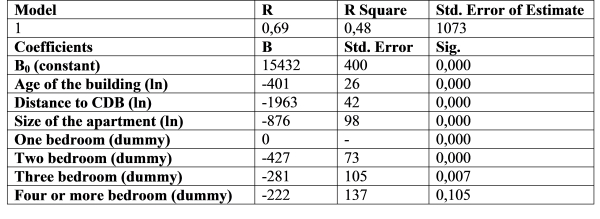

The reach of the impact of a subway station has been analyzed in

several studies. The studies show that the impact on property values can

reach for almost five kilometers away (see Table 1). According to Dewees

(1976) the impact area reaches to 1600 meters. McMillen and McDonald

(2004) discovered that the impact reaches up to 2400 meters. Bowes and

Ihanfeldt (2001, p. 15-18) show that the impact to the price is negative

when located close to a subway station, but after 400 meters the impact

turns positive. Brandt and Manning (2012, p. 1009-1011) estimated that

the impact is the biggest when reaching a distance of 250 to 750 meters

from a station. In every study that was reviewed in this study the

impact area reached at least to 400 meters. This distance is considered

to be the minimum distance for which the new subway station has at least

impact. The different values in one row are those limits, where the

impact changes.

Table 1. Previous research on impact areas of subway.

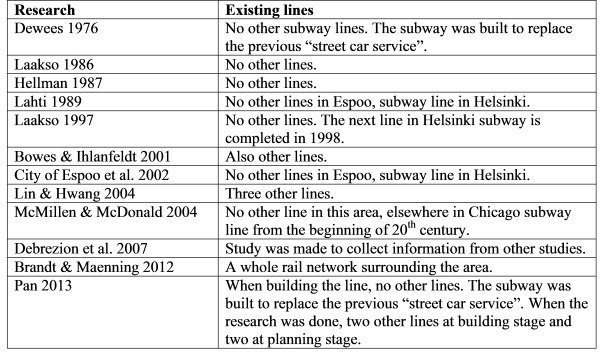

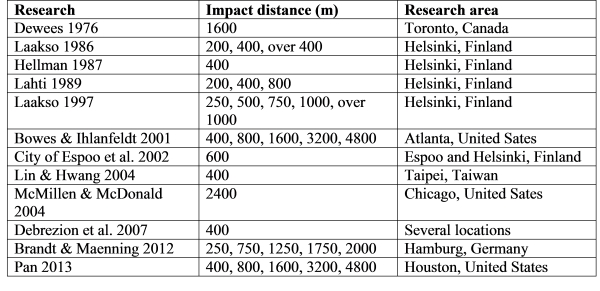

When reviewing the previous studies, it has to be noted that in this

case area the subway line is built to an area with no existing subway

lines. This will most probably have an effect on how far the effect of

the new subway line reach. If the research area has already several

existing subway lines, the impact area of a new line may be smaller

because the density of the stations is bigger and due to that, they

collect less people from the surrounding area. Table 2 presents the

existence of subway lines in the research areas of the previous

researches. Based on the background information of the previous

researches, the most similar areas compared to the studied area are

those which concern the new subway line in Espoo (Lahti 1989; City of

Espoo et al. 2002), the Helsinki subway (Laakso 1997), the Toronto

subway (Dewees 1976) and Chicago subway (McMillen & McDonald 2004). In

these studies the impact reaches from 600 meters to 2400 meters. The

City of Espoo et al. (2002) examined the impact of the new subway line

and found it to be 600 meters on average from each subway station. As

the subway in the case area is being built in the City of Espoo, the

estimate from last source can be seen as the most reliable one.

Table 2. The existing subway lines in the previous research areas.

When building the line, no other lines. The subway was built to

replace the previous “street car service”. When the research was done,

two other lines at building stage and two at planning stage.

Based on the previous studies it can be stated that the impacts of a

subway station reach almost certain to a distance of 400 meters. This is

the minimum distance used in this study. The maximum distance chosen for

this study is 800 meters since the density of stations of the new line

is rather large. By choosing the maximum distance of impact to be 800

meters, the goal is to avoid overlapping estimation of impacts of

several stations.

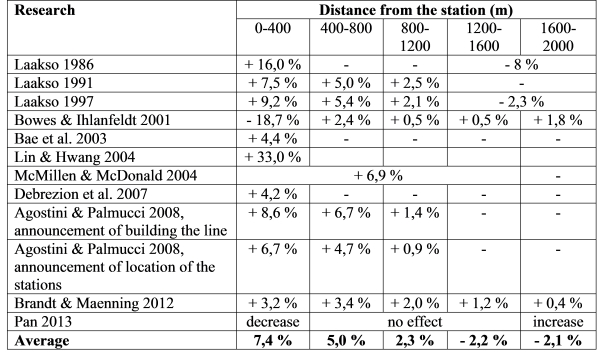

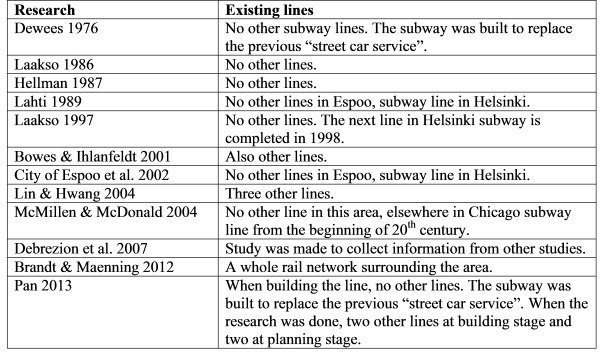

The previous Finnish studies show that the impact of building a

subway has only positive effects. The price increases of residential

properties near the subway station (< 400 m) varied from 7,5 to 16

percent (Laakso 1997; Laakso 1991; Laakso 1986). More variance can be

detected in international studies where the impact near the subway

stations varies from – 18,7 to 33 percent. The property value impacts

form the reviewed articles are presented in Table 3.

Table 3. The change in prices of residential properties.

The international studies show that the impacts of a metro station to

the prices of residential properties vary strongly. A study made by

Bowes and Ihlanfeldt (2001) reveals also a negative impact when

examining the close surroundings of a metro station. A possible

explanation for this may be that this particular study takes also the

crime statistics into account. Overall, the variation in impact areas

between different studies can be explained by variation in research data

and methodology. Each of the studies needs to be carefully revised when

comparing the impact areas.

3 MATERIALS AND METHODS

3.1 Study material

3.1.1 Apartment prices

Apartments are classified as private properties in the Finnish

legislation. The Finnish purchase price register has information only

concerning real property transactions. Only the Finnish tax officials

have the full information on realized prices form apartment transactions

and this information is not available, even for research purposes. The

Finnish realtors have, however, their own price register on apartment

prices which they publish online (www.asuntojen.hintatiedot.fi). The

information is available only from the past 12 months. Transactions are

presented only if there are three or more transactions in the same

postcode. Only the major realtors are publishing transactions. These

restrictions mean that on average, approximately half of the

transactions are listed in this online price register. (Tuominen 2014,

p. 37-39). Information that is this price register include: transaction

price, postcode, number of bedrooms, area, construction year, floor,

elevator (yes/no), balcony or yard (yes/no) and condition

(poor/satisfactory/good).

Information for this study was collected from the mentioned price

register in 21st February 2014. Transactions were selected from two

cities, Helsinki and Espoo. Total 3 431 transaction were found and 11

from those were eliminated because they were most likely parking slots

or similar utilities inside apartment buildings. Transactions were made

in 177 different postcode areas. The construction years varied from

1 874 to 2 015. 5 percent of the apartments were in poor condition, 41

percent in satisfactory condition and 54 percent in good condition. 60

percent of the apartments had an elevator and 25 percent a balcony or a

yard. The floors varied from 1 to 17 and the number of bedrooms from 1

to 4 (or bigger). The average price per square meter was 4 234 €.

Also an additional variable regarding travelling time to central

business district (CBD) was added to the study material. The travelling

time to CDB was defined by using the official route calculator (www.reittiopas.fi)

that analyses travelling time (minutes) with the chosen transportation.

Finally, the material was coded for hedonic approach.

3.1.2 Apartments

The information about apartments and their characteristics itself is

widely available. In this study a public database (SeutuCD) was utilized

to collect the information about apartment characteristics on the

residential area (Matinkylä) that was chosen as the case area. By

utilizing the answers to Q1, represented in Literature review, the

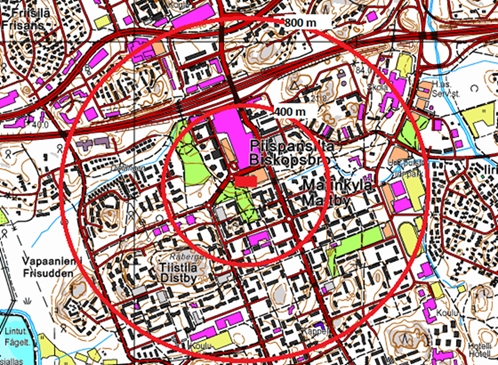

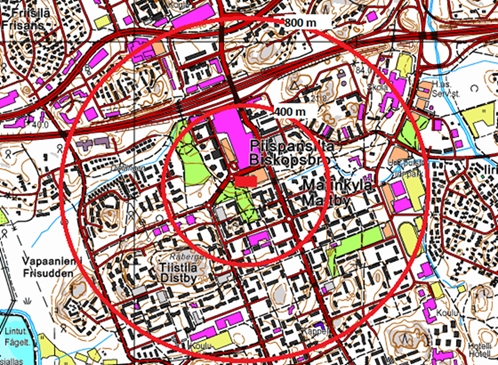

information about apartment characteristics was collected. Figure 1

shows the study area and illustrates the surroundings on different

distances (400 meters, 800 meters).

Figure 1: Matinkylä resindential area. The information about

apartment characteristics was collected by using two radius (either 400

or 800 metres) around the new subway station.

Inside 400 meter radius there were 77 apartment houses and inside 800

meter radius 561 apartment houses. The age of the apartment houses

varied from 1 to 55 years, average being 25.

Following information was collected concerning each apartment inside

an apartment house: age, number of bedrooms and size of the apartment.

Also two additional variables regarding travelling time to CBD were

added to the study material. First of all, the current travelling time

was added by utilizing the official route calculator. Then the future

travelling time (after the subway is built) was added. This was done by

calculating the travelling time as a sum of the time spent on the way to

the subway station and on the subway itself. The route calculator was

utilized to estimate the time spent between each apartment and the

subway station and the timetables of the new subway (published already!)

to estimate the time spent in the subway.

3.2 Methodology

The average price impact (Q2) is calculated with hedonic price

functions. Econometrically, hedonic price models are estimated with the

Ordinary Least Squares (OLS)

method. The idea of hedonic pricing is to consider housing as a

multi-dimensional differentiated good. Hedonic equations are used to

decompose housing rent or value into measurable prices and quantities

that can be used to estimate rents or values of different dwelling

combinations. A hedonic estimation is simply a regression of

expenditures on the housing characteristics. The regression coefficients

may be transferred into implicit price estimates of these

characteristics.

There are many features affecting housing prices, the most common

categories being structural, neighborhood and locational

characteristics. Malpezzi (2003) presents the fundamental hedonic

equation simply as follows [1]:

P = f(S, N, L, C, T), where:

P = price / value of the dwelling, S = structural characteristics, N =

neighborhood characteristics, L = location, C = contract conditions or

characteristics, and T = the time rent or value is observed.

There is no such thing as an established functional hedonic form in

the literature of urban economics (see e.g. Halvorsen and Pollakowski

1981, Malpezzi 2003). Pioneering papers on hedonic analysis like

Lancaster (1966) and Rosen (1974) provide little help for choosing the

functional form. One of the most important findings of the hedonic

pricing theory is the nonlinearity of the value function (Laakso 1997).

Nonlinearity stems from the non-divisibility feature of housing. In

practice, the nonlinearity is taken into account by using the natural

logarithm of price as the dependent variables.

Different authors have tried different models to find the best fit.

For instance, in his literature review on empirical studies on housing

prices, rents and land prices, Laakso (1997) concludes that the most

common functional forms are log-linear and semi-log forms. Flexible

functional forms and the Box-Cox transformation are also common. Laakso

concludes that when the size of the data set allows the use of dummy

variables, dummy variable models are superior as compared with

continuous variable models regarding R2 statistics and homoscedasticity.

Furthermore, the results of dummy models are simple to interpret. After

having reviewed a number of hedonic pricing studies, Sirmans et al.

(2005) conclude that linear and semi-logarithmic specifications are the

most common ones.

In this study, the data was analyzed using the ordinary least squares

method. The general form of the linear regression model is as follows [2]:

where β0 is the intercept, β1–n measure the change in y with respect

to x1–n, while holding all other factors fixed, and u is the error term.

The estimated equation expresses the price per square meter as a

function of the independent variables. An attempt was made to take a

natural logarithm of the unit price, but the linear form was found to be

a better fit.

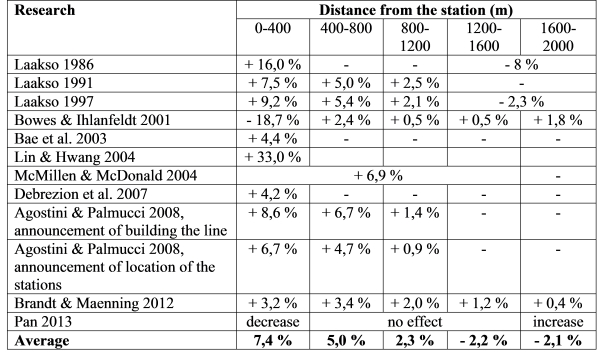

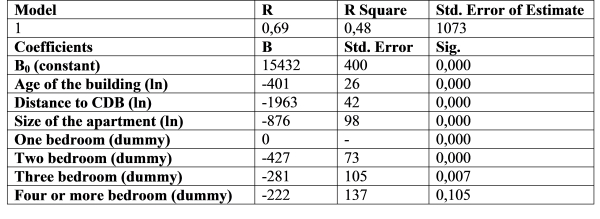

After a number of iteration, the best equation that could be formed

based on the data available is presented in Table 4. As seen in Table 4,

only four variables were found statistically significant (at 1 percent

level). The variables that were not included in the model were: floor,

elevator (dummy), balcony (dummy), condition, municipality, and distance

by private car. Even the condition of the apartment could not be

included to the model because of its strong correlation between the ages

of the buildings as was the correlation between distance by private car

and distance to CBD. The model accounted for 48 percent (R2) of the

variance in the apartment prices which is not very good comparing price

models in general. But in this case where the data is limited it was the

best achievable result. The result could have been better if some

proportion of the observations that didn’t fit the model had been

eliminated from the study material. But as we had no other evidence than

the price to conclude if the observation was representative, practically

all of the observations were included in the analyses.

Table 4: The hedonic model from apartment transactions in Helsinki

metropolitan area between 22.2.1013

The model presented in Table 4 is used to analyze the answers to Q2

and Q3. For Q3, the formula is used to calculate a value estimate for

every apartment in the study areas (400 meter, 800 meter), both before

and after the new subway station is in use. The difference between these

two values in both areas is considered to give an answer to the question

how big (€) is the total impact (Q3). When the total impact is divided

among single apartments, an estimate on how big (%) is the average

impact (Q2) can be given.

If we would like to give an estimate for an expected price change for

a single 80 square meter apartment that is built in 1967 (age 48), has 3

bedrooms and has now 35 minutes distance to CDB and afterwards 30

minutes distance to CDB, the formula can be formed as:

Price (before) = 15432 – 401 x ln(48) – 1963 x ln(35) – 876 x ln(80) –

282 x 1 = 2780 €/m2

80 meters x 2780 €/m2 = 222 400 €

Price (after) = 15432 – 401 x ln(48) – 1963 x ln(30) – 876 x ln(80) –

282 x 1 = 3082 €/m2

80 meters x 3082 €/m2 = 246 600 €

In this case the total impact would be 24 200 € and the average impact

11 percent.

To analyze the impact on public revenues the total impact (Q3) is

multiplied with annual property tax (0,8 percent) and capitalized to 30

years with 5 percent interest rate. This discount rate and time period

was chosen because they are generally used for cost-benefit analyses in

public investment projects in Finland.

4 RESULTS

This study was set up to analyze the impact that the new subway line

has on apartment prices and on public revenues. In the literature review

it was observed that a new subway station has an impact that reaches in

most surroundings at least to 400 meters. In the studied area, the reach

of the impact regarding property prices was estimated to be somewhere

between 400 and 800 meters. In the studied area other subway stations

are located quite close to each other and after 800 meters it is

difficult to estimate which station “makes” the impact.

The impact that the new subway station has on residential apartment

prices is on average 15 percent in 0-400 meter radius and 11 percent in

0-800 meter radius. The total impact in the studied residential area

Matinkylä was 122 million euros in 0-400 meter radius and 193 million

euros in 0-800 meter radius.

When the impact is totally capitalized to apartment prices, the

annual tax revenues will increase approximately 1,0-1,5 million euros.

Therefore, the capitalized impact to the public revenues from the

increased property taxes is approximately 15-24 million euros in the

studied area. There are eight new subway stations in the city of Espoo.

If the average revenue from each station is somewhere in the same range,

the tax revenues increase ca 120-189 million euros in total. For the

city of Espoo this means that the tax revenues from property taxes

increase for almost 10 percent which a little bit more than what is

found elsewhere. For example in Chile, the building of a new subway line

was estimated to increase property taxes by 7,5 percent (Agostini and

Palmucci 2012, p. 72). On the other hand, Brandt and Maenning (2012, p.

1014) noted that the property tax is not the only tax increasing, also

the transfer taxes increase.

Whether or not the increase in the tax revenue is considered as a

major benefit, the majority of the revenues go to private property

owners. They have the actual possibility to collect the value increase

by selling their properties. It has to be reminded as well that the

increase in value does not happen overnight. The value increase has

probably started several years ago when the first discussions about the

new subway line were started. The benefits are not most probably yet

totally capitalized in the values of the apartments. The long time

period in the value creation makes it difficult to study if the study

material does not include observations from several years.

The methodology utilized in this article does not observe the actual

price changes that the new subway line creates. This study estimates

only the impacts by analyzing the differences of distances. This

methodology is chosen, not because it is the most reliable one but

rather because it is the most suitable one with the material at hand. If

there had been information about apartment prices more widely available,

especially from several years, the methodology could have been altered.

This methodology does not take into account that subway station most

probably have adverse (noice, crimes etc.) effects as well (Brandt &

Maenning 2012).

If the results of this study are compared to previous studies, it can

be observed that the value increase estimated in this study is higher

than in most studies. Most relevant studies that can be compared are the

Finnish ones, in which the average value increase was 1-6 unit percent

lower. This might be explained with the adverse effects that are

excluded in the methodology applied in this study.

6 DISCUSSION AND CONCLUSIONS

The subway is one of the largest investments in the public

infrastructure in the Helsinki metropolitan area. The construction of a

new subway line has an impact on housing prices which is not negligible.

The price tag for a new subway line was approximately 700 million euros.

There has been a wide debate on whether this will be a profitable

investment. A better question would have been, for who is it profitable.

The result of this study showed that the apartment prices increase

122-193 million euros in just one residential area. As there are nine

residential areas where the new subway will have an effect on, it is

undeniable that the investment is profitable. However, most of the

profits are collected by individual property owners and whether this

should be included in the profitability analyses at all, is a political

choice rather than an empirical question.

The construction of a new subway has also a lot of other impacts that

are not in the scope of this study. But in the discussion part the most

important ones cannot be forgotten. First of all, there is a lot of

evidence that public-transit induced premium on sales does not concern

only apartments houses but also other property types, especially office

and retail spaces (Laakso 1986, p. 27; Lahti 1989, p. 66, 97; Debrezion

et al. 2007, p. 161). A new subway also changes the land use near the

subway station to a more efficient one which might have major impacts on

employment. The economic boost that the new subway creates has increased

at least retail and service business near the stations and on the other

hand reduced industrial areas on the neighborhoods. (Bae et al. 2003, p.

92-93). This all fits well to Alonso’s (1968) basic theory on location

and land use.

The reasons why the subway is being built now and not earlier is the

adverse effects that the citizens are afraid of. In some areas of

Helsinki the surroundings of a subway station are not especially

appealing. Will the surroundings change to an undesirable direction is a

question that can only be speculated. The same concerns the public

debate on drug problems that have been added to the list of adverse

effects of a new subway. If the property values increase it does not

seem probable that the surroundings will change for the worse. For us it

does not seem very likely either that the increase in apartment prices

will be used on drugs. One of the interesting implications of the

positive impact of the new subway line on housing prices is the

associated increase in property tax revenues. Our estimations imply a

tax revenue increase ca 10 percent. This could potentially be earmarked

either for the new investments in the subway lines or to the prevention

of the adverse effects that the new subway might cause. Perhaps this

would be the opening in the upcoming debates on whether or not to build

more subway lines in the Helsinki metropolitan area.

REFERENCES

Agostini, C. & Palmucci, G. (2008) The Impact of a New Subway Line on

Property Values in Santiago. National Tax Association, Tax Insitute of

America. Proceedings of the Annual Conference on Taxation. s. 70-75.

ISSN 1066-8608.

Alonso, W. (1968) Location and Land Use: toward a general theory of

land rent. Harvard University Press. 205 p.

Bae, C-H. C., Jun, M-J., Park, H. (2003) The impact of Seoul’s subway

Line 5 on residential property values. Transport Policy. Vol 10:2. s.

85-94. ISSN 0967-070X.

Bowes, D. R. & Ihlanfeldt K. R. (2001) Identifying the Impacts of

Rail Transit Stations on Residential Property Values. Journal of Urban

Economics. Vol 50:1. s. 1-25. ISSN 0094-1190.

Brandt, S. & Maenning, W. (2012) The impact of rail access on

condominium prices in Hamburg. Transportation. Vol 39:5. s. 997-1017.

ISSN 0049-4488.

City of Espoo, City of Helsinki, Ministry of Transport and

Communications. (2002) Länsimetro Ruoholahti-Matinkylä. Tarve- ja

toteuttamiskelpoisuusselvitys. II-vaihe: Metrojärjestelmän ja

bussijärjestelmän vertailu.

Debrezion, G., Pels, E., Rietveld, P. (2007) The Impact of Railway

Stations on Residential and Commercial Property Value: A Meta-analysis.

Journal of Real Estate Finance and Economics. Vol 35:2. s. 161-180. ISSN

0895-5638.

Dewees, D. N. (1976) The Effect of a Subway on Residential Property

Values in Toronto. Journal of Urban Economics. Vol 3:4. s. 357-369. ISSN

0094-1190.

Halvorsen, R., Pollakowski, H. O., (1981). Choice of functional form

for hedonic price equations. Journal of Urban Economics 10, no.1: 37-49.

Hellman, T. (1987) Metro ja kaupunkirakenne. Metro ja maankäytön

muutokset. Helsingin kaupungin kaupunkisuunnitteluvirasto,

Yleiskaavaosasto. Julkaisu YB:5/87. 65 s. + liitt. 7 s. ISBN

951-771-685-0.

Laakso, S. (1986) Metro ja kaupunkirakenne. Helsingin metron vaikutus

asuntojen hintoihin ja toimistotilojen vuokriin. Helsingin kaupungin

kaupunkisuunnitteluvirasto, Yleiskaa-vaosasto. Julkaisu YB:17/86. 35 s.

+ liitt. 27 s. ISBN 951-771-647-8.

Laakso, S. (1991) Metro ja kaupunkirakenne seurantatutkimus.

Helsingin kaupunkisuun-nitteluviraston julkaisuja 1991:6. 64 s. + liitt.

6 s. ISBN 951-772-136-6.

Laakso, S., (1997). Urban housing prices and the demand for housing

characteristics: a study on housing prices and willingness to pay for

housing characteristics and local public goods in Helsinki metropolitan

area, ETLA – The Research Institute of the Finnish Economy.

Lahti, P. (1989) Suurten liikennejärjestelyiden

yhdyskuntarakenteelliset vaikutukset: kolme esimerkkiä. Valtion

teknillinen tutkimuskeskus, Tiedotteita 1023. Espoo: VTT Off-setpaino.

246 s. ISBN 951-38-3511-1.

Lancaster, K. J., (1966). A new approach to consumer theory. Journal

of Political Economy, 74, 1966, pp. 132-57.

Lin, J-J. & Hwang, C-H. (2004) Analysis of property prices before and

after the opening of the Taipei subway system. The Annals of Regional

Science. Vol 38:4. s. 687-704. ISSN 0570-1864.

Malpezzi, S.,( 2003). Hedonic pricing models: a selective and applied

review. Housing Economics: Essays in Honor of Duncan Maclennan, Edited

by K. Gibb and A. O'Sullivan. Blackwell.

McMillen, D. P. & McDonald, J. (2004) Reaction of House Prices to a

New Rapid Transit Line: Chicago’s Midway Line, 1983-1999. Real Estate

Economics. Vol 32:3. s. 463-486. ISSN 1080-8620.

Mills, E. S. (1967) Transportation and patterns of urban development.

An Aggregative Model of Resources Allocation in a Metropolitan area.

American Economic Review. Vol 57:2. ISSN 0002-8282. pp. 197-210.

Muth, R. F. (1970) Cities and Housing: The Spatial Pattern of Urban

Residential Land Use. The University of Chicago Press. ISBN:

0-226-55413-9. 355 p.

Pan, Q. (2013) The impacts of un urban light rail system on

residential property values: a case study of the Houston METRORail

transit line. Transportation Planning and Techno-logy. Vol 36:2. s.

145-169. ISSN 1029-0354.

Rosen, S. (1974). Hedonic prices and implicit markets: product

differentiation in pure competition. Journal of Political Economy, Vol.

82, Issue 1, pp. 34-55.

Sirmans, G. S., Macpherson, D. and Zietz, E. (2005). The Composition

of Hedonic Pricing Models, Journal of Real Estate Literature, Vol. 13

Issue 1, pp. 3-43.

Tuominen, H. (2014). The impact of the West metro on the value of

residential apartments. Master’s thesis. Aalto University School of

Engineering, Department of Real Estate, Planning and Geoinformatics. 64

p.

BIOGRAPHICAL NOTES

Mr. Juhana Hiironen, Doctor of Science (Land

management) 2012, Department of Real Estate, Planning and Geoinformatics

at Aalto University School of Engineering. Dr. Hiironen has made his

Doctoral Dissertation on “On the Impacts and Profitability of Farmland

Consolidation”.

Ms. Kirsikka Niukkanen, Doctor of Science (Land

management) 2014, Department of Real Estate, Planning and Geoinformatics

at Aalto University School of Engineering. Dr. Niukkanen made her

Doctoral Dissertation on “On the Property Rights in Finland – the point

of view of Legal Cadastral Domain Model”.

Ms. Hanna Tuominen, Master of Science (Engineering)

2014, Department of Real Estate, Planning and Geoinformatics at Aalto

University School of Engineering. Ms. Tuominen works as a site manager

construction company (Lemminkäinen Infra Oy) that builds subways among

other things.

CONTACTS

Research Fellow (Dr.Tech)

Aalto University

School of Engineering

Department of Real Estate, Planning and Geoinformatics

P.O. Box 12200

00076 Aalto

FINLAND

Email: juhana.hiironen[at]nls.fi

Web site: http://maa.tkk.fi/en/

Postdoctoral Researcher Kirsikka Riekkinen (Dr.Tech)

Aalto University

School of Engineering

Department of Real Estate, Planning and Geoinformatics

P.O. Box 12200

00076 Aalto

FINLAND

Email: kirsikka.riekkinen[AT]aalto.fi

Web site: http://maa.tkk.fi/en/

Site Manager Hanna Tuominen (M.Sc)

Lemminkäinen Infra Oy

P.O. Box 169

00181 Helsinki

FINLAND

Email: hanna.tuominen[at]lemminkainen.com

Web site:

http://www.lemminkainen.com/Lemminkainen/Company/

|